Uncover hidden threats in global payments - turn risk into growth

Correspondent banks are key to the global banking payment system but detecting criminal activity is no small feat when you must:

-

Navigate complex transaction chains.

-

Deal with little transparency into the originator or beneficiary.

-

Manage large transaction volumes or amounts.

-

Stay compliant with legislation in multiple jurisdictions.

.png)

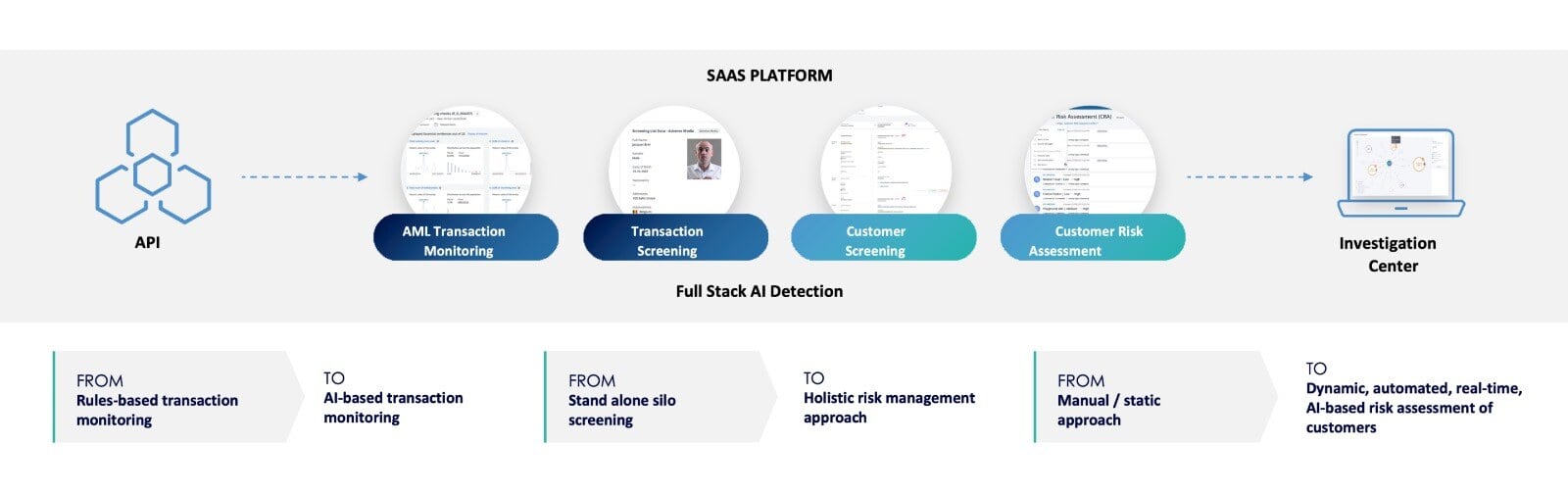

ThetaRay Core Offering

From rules and silos to real-time AI risk managment

.png?width=2000&height=752&name=Group%2012%20(3).png)

So, how can we help?

Trusted by

Over 100+ banks & fintechs globally rely on ThetaRay to detect financial crime and support their complaint growth.

With ThetaRay by your side, achieve business growth with trusted customers anywhere!

Expanded risk coverage

60+ out-the-box risk indicators covering all major global risk typologies developed in partnership with global banks, plus hidden threat detection.

Accurate and actionable alerts

Focus on actionable alerts - significantly reduce efforts on false positives and unnecessary investigations.

Unbiased anomaly detection

Monitor every step in the payment corridor for full transparency and understand database relationships without bias or heuristic rules.

.png)

Highly complex analytics

Conduct analytics on huge volumes of data in minutes - not months. Detect new and unpredictable typologies without relying on predefined scenarios or models.

-

Accelerate business growth

-

Improve customer satisfaction

-

Reduce compliance costs

-

Increase risk coverage